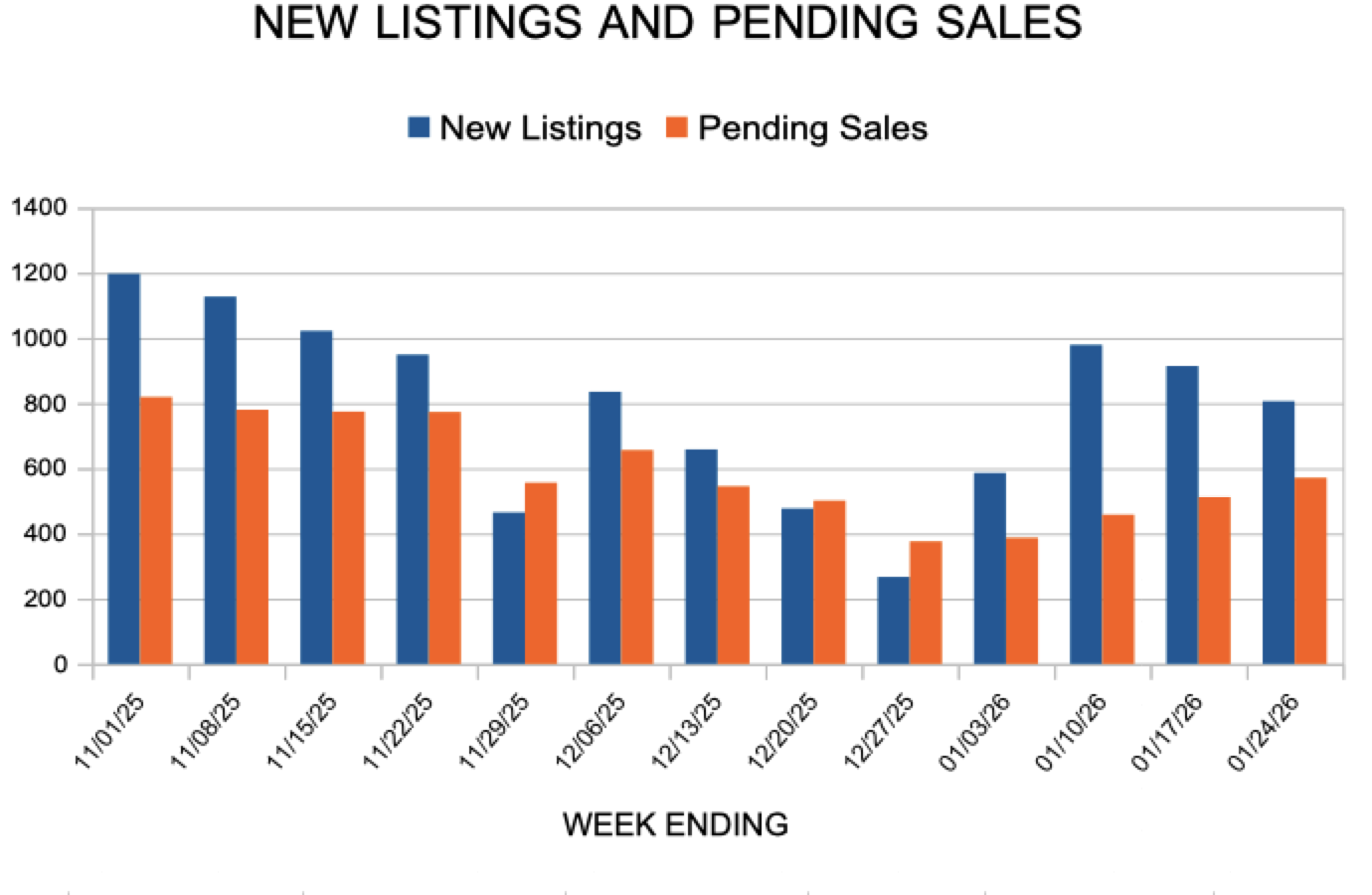

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

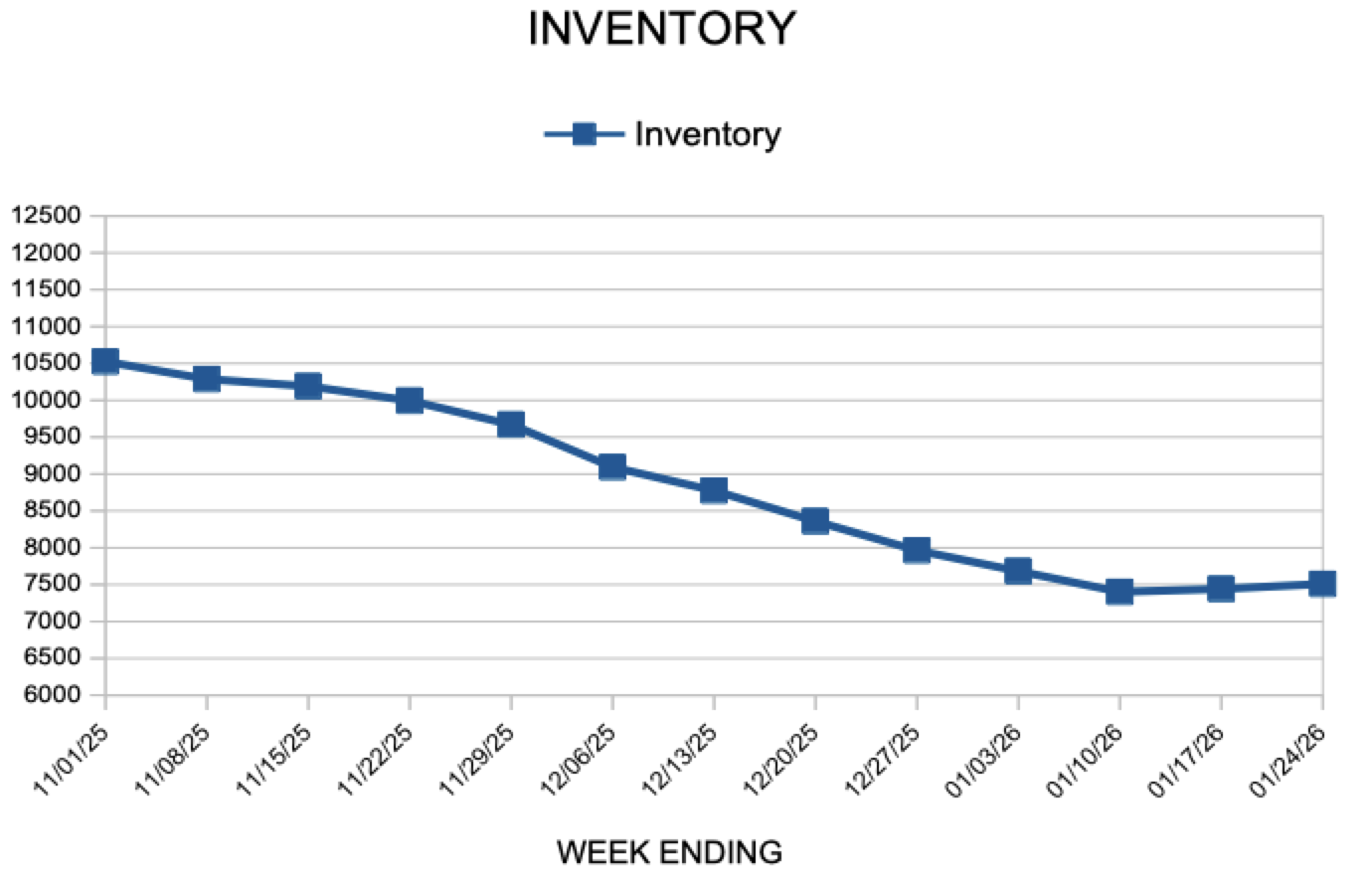

Inventory

Inventory

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 60

- Next Page »