For Week Ending August 31, 2024

For Week Ending August 31, 2024

49.2% of mortgaged residential properties in the U.S. were considered equity rich—having at least 50% equity in one’s home–in the second quarter of 2024, according to ATTOM’s Q2 2024 U.S. Home Equity and Underwater Report. This is an increase from the previous quarter, when 45.8% of mortgaged homes were considered equity-rich, with the largest quarterly increases found in lower-priced markets in the South and Midwest regions.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 31:

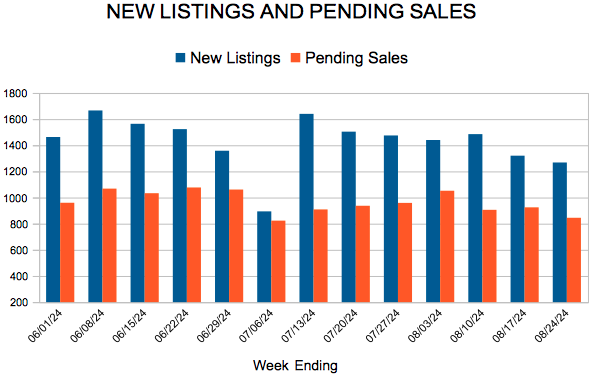

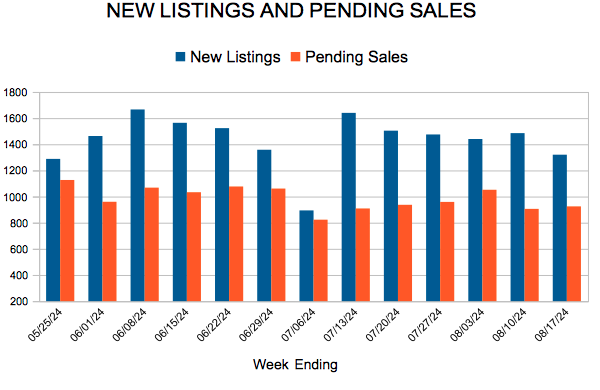

- New Listings decreased 10.7% to 1,096

- Pending Sales decreased 8.5% to 870

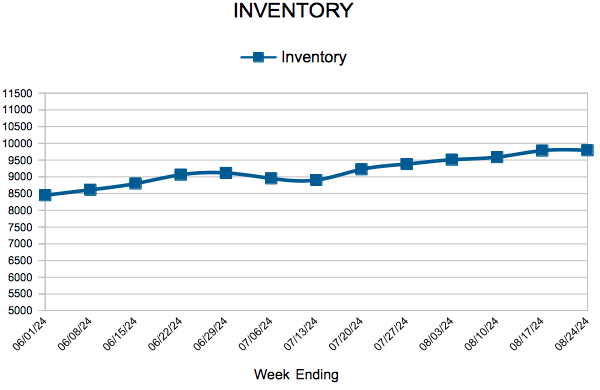

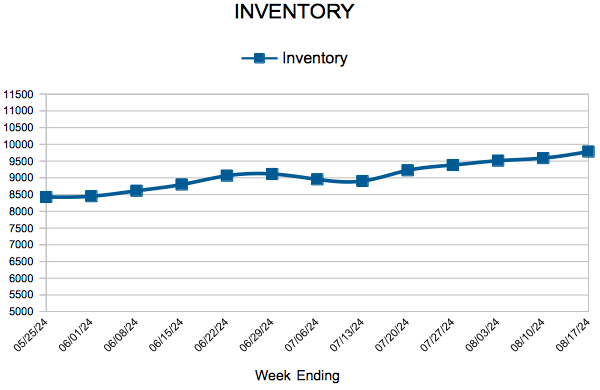

- Inventory increased 12.7% to 9,842

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.7% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.