Mortgage Rates Drop Slightly

December 18, 2025

The average 30-year fixed-rate mortgage has remained within a narrow 10-basis point range over the last two months. With rates down half a percent over last year, purchase applications are 10% above the same time one year ago.

- The 30-year fixed-rate mortgage averaged 6.21% as of December 18, 2025, down slightly from last week when it averaged 6.22%. A year ago at this time, the 30-year FRM averaged 6.72%.

- The 15-year fixed-rate mortgage averaged 5.47%, down from last week when it averaged 5.54%. A year ago at this time, the 15-year FRM averaged 5.92%.

Information provided by Freddie Mac.

New Listings and Pending Sales

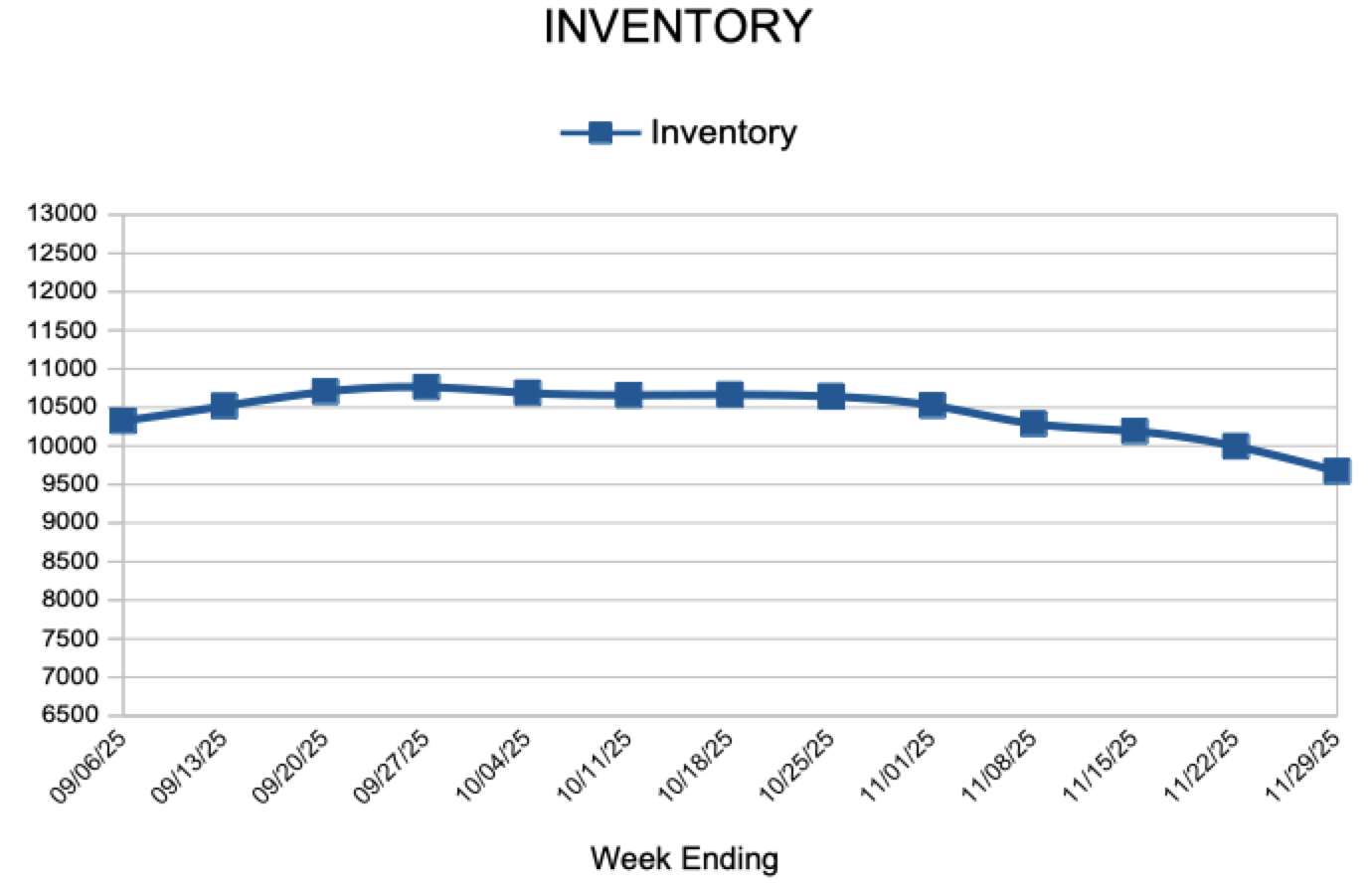

Inventory

Weekly Market Report

For Week Ending December 6, 2025

For Week Ending December 6, 2025

At last measure, 34% of older households (those led by someone age 65 or over) were cost burdened, according to Harvard University’s Joint Center for Housing Studies’ State of the Nation’s Housing 2025 report. Over 12.4 million of these households spent more than 30% of their income on housing, and more than half of them (6.7 million) paid over 50% in 2023.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECDEMBER 6:

- New Listings decreased 2.1% to 835

- Pending Sales decreased 8.8% to 656

- Inventory decreased 1.4% to 9,093

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.8% to $386,647

- Days on Market remained flat at 50

- Percent of Original List Price Received decreased 0.2% to 97.4%

- Months Supply of Homes For Sale decreased 4.0% to 2.4

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Remain Near 2025 Lows

December 11, 2025

The average 30-year fixed-rate mortgage is well below the year-to-date average of 6.62%, providing some sense of balance to the housing market.

- The 30-year fixed-rate mortgage averaged 6.22% as of December 11, 2025, up from last week when it averaged 6.19%. A year ago at this time, the 30-year FRM averaged 6.60%.

- The 15-year fixed-rate mortgage averaged 5.54%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 5.84%.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 29, 2025

For Week Ending November 29, 2025

U.S. homeowners earned an average profit of 49.9% on the sale of single-family homes and condominiums in the third quarter of 2025, according to ATTOM’s latest U.S. Home Sales Report. That figure is up slightly from 49.3% in the second quarter, but remains below the 55.4% recorded during the third quarter of 2024. The typical homeowner realized a profit of $123,100 in the third quarter, up 1.9% from the previous quarter but down 3.5% from a year earlier.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 29:

- New Listings decreased 11.6% to 465

- Pending Sales decreased 7.0% to 556

- Inventory increased 0.5% to 9,671

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Move Down

December 4, 2025

Mortgage rates decreased for the second straight week, emerging from the Thanksgiving holiday. Compared to this time last year, mortgage rates are half a percent lower, creating a more favorable environment for homebuyers and homeowners.

- The 30-year fixed-rate mortgage averaged 6.19% as of December 4, 2025, down from last week when it averaged 6.23%. A year ago at this time, the 30-year FRM averaged 6.69%.

- The 15-year fixed-rate mortgage averaged 5.44%, down from last week when it averaged 5.51%. A year ago at this time, the 15-year FRM averaged 5.96%.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 60

- Next Page »