For Week Ending December 27, 2025

For Week Ending December 27, 2025

Nationally, 46.1% of mortgaged residential properties were classified as equity-rich in the third quarter of 2025, according to ATTOM’s latest 2025 U.S. Home Equity & Underwater Report. This marks a slight decline from 47.4% the previous quarter and from 48.3% the same time last year. The three states with the highest share of equity-rich properties were Vermont (86.8%), New Hampshire (61.4%), and Rhode Island (59.8%).

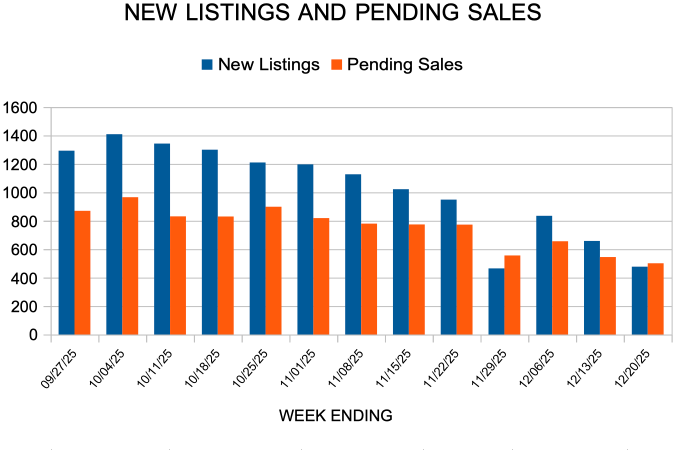

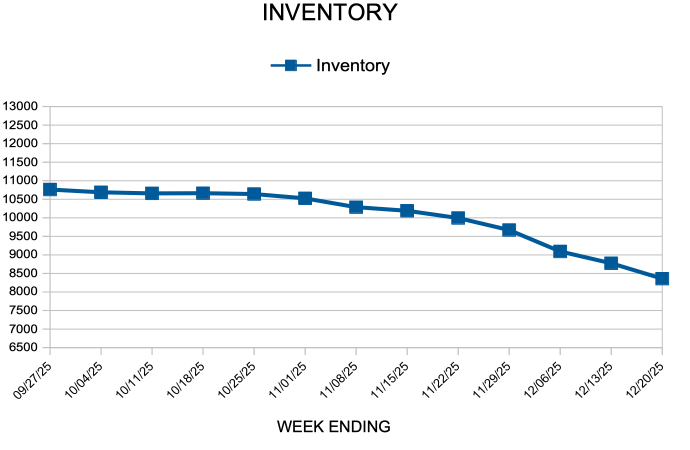

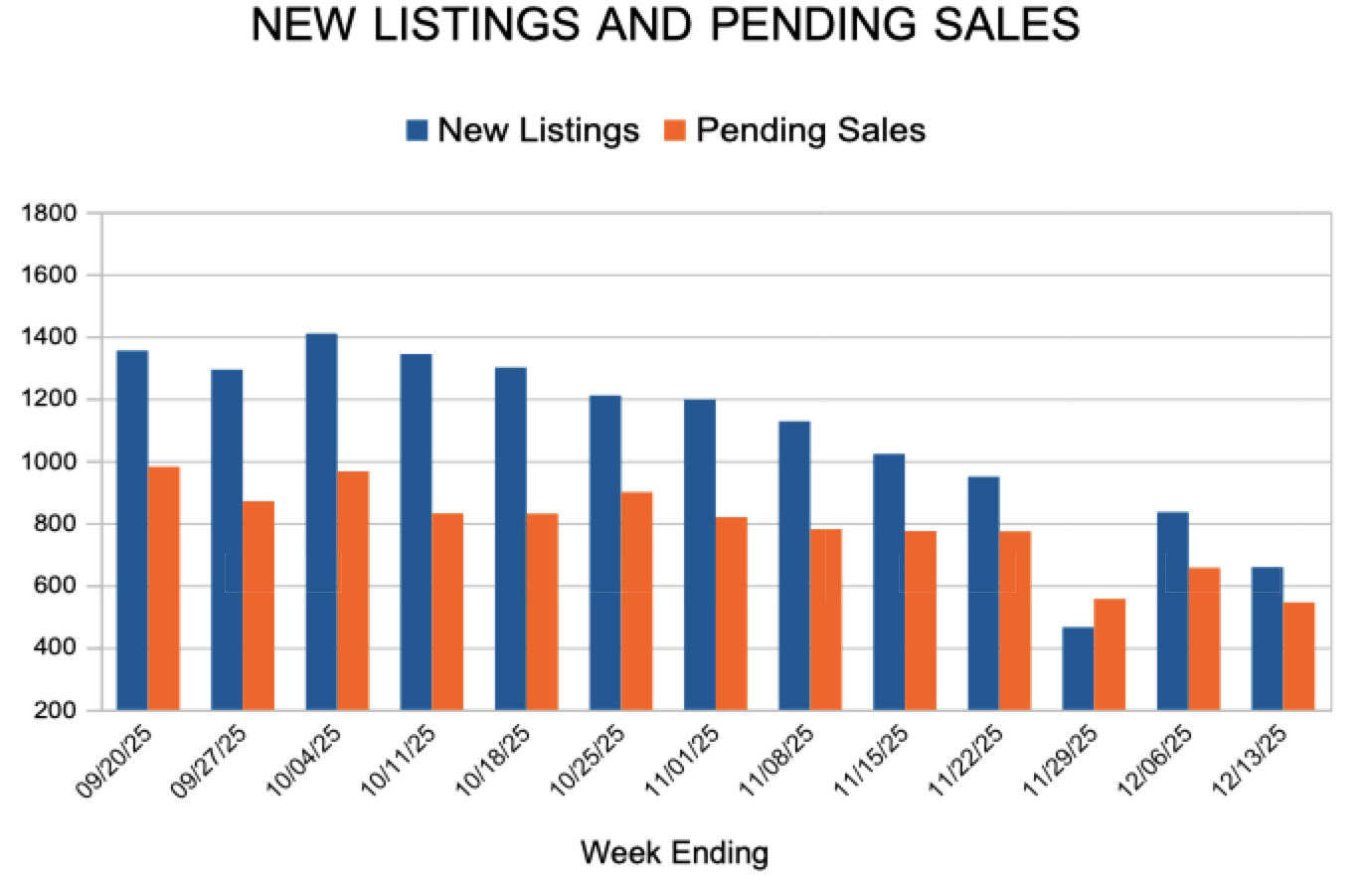

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 27:

- New Listings decreased 22.4% to 267

- Pending Sales decreased 11.9% to 376

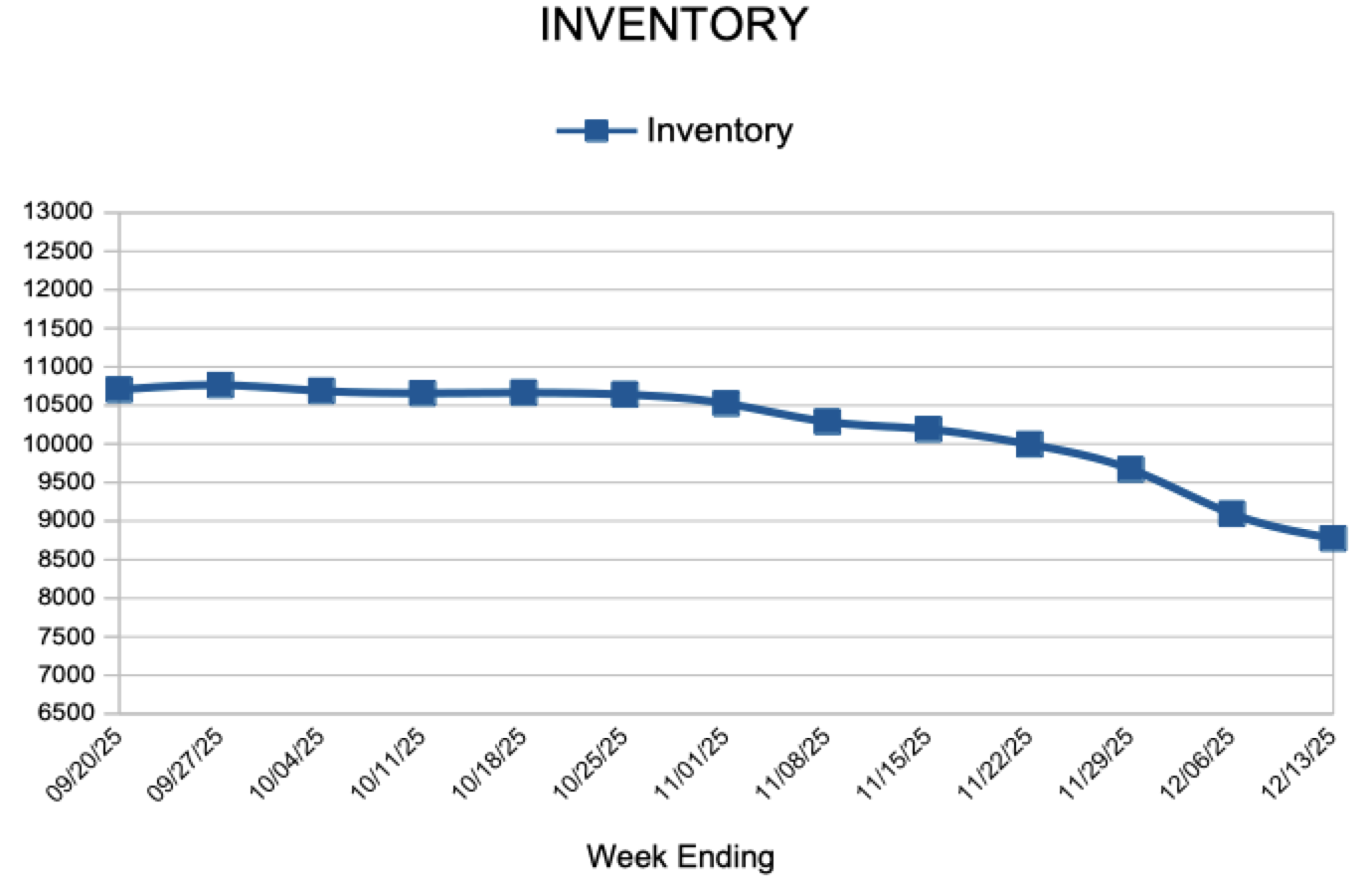

- Inventory decreased 2.9% to 7,964

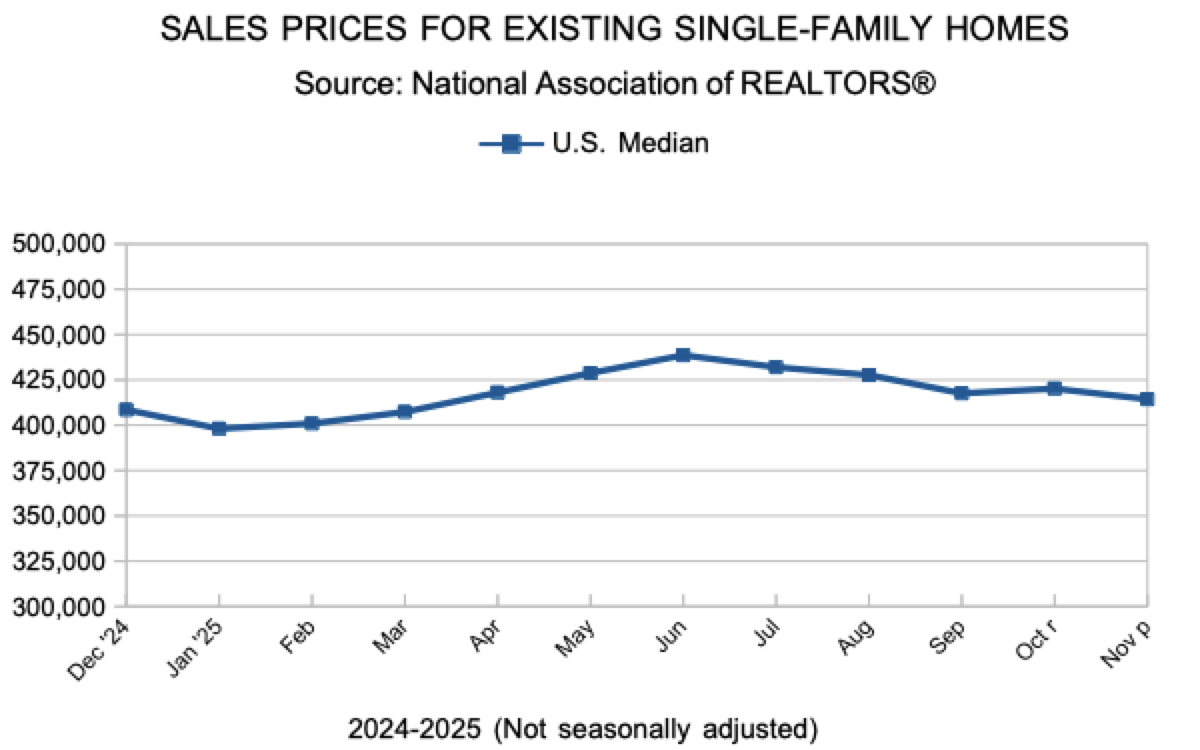

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.9% to $387,000

- Days on Market remained flat at 50

- Percent of Original List Price Received decreased 0.2% to 97.4%

- Months Supply of Homes For Sale remained flat at 2.

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.