For Week Ending November 22, 2025

For Week Ending November 22, 2025

Nearly one-third (32.8%) of all homes sold in the first half of 2025 were paid for in cash, down 0.6% from the same period last year, according to a recent report from Realtor®.com. Cash sales were most common at the low and high ends of the price spectrum and vary across regions, with lower-priced and second-home markets often seeing more all-cash transactions than other areas.

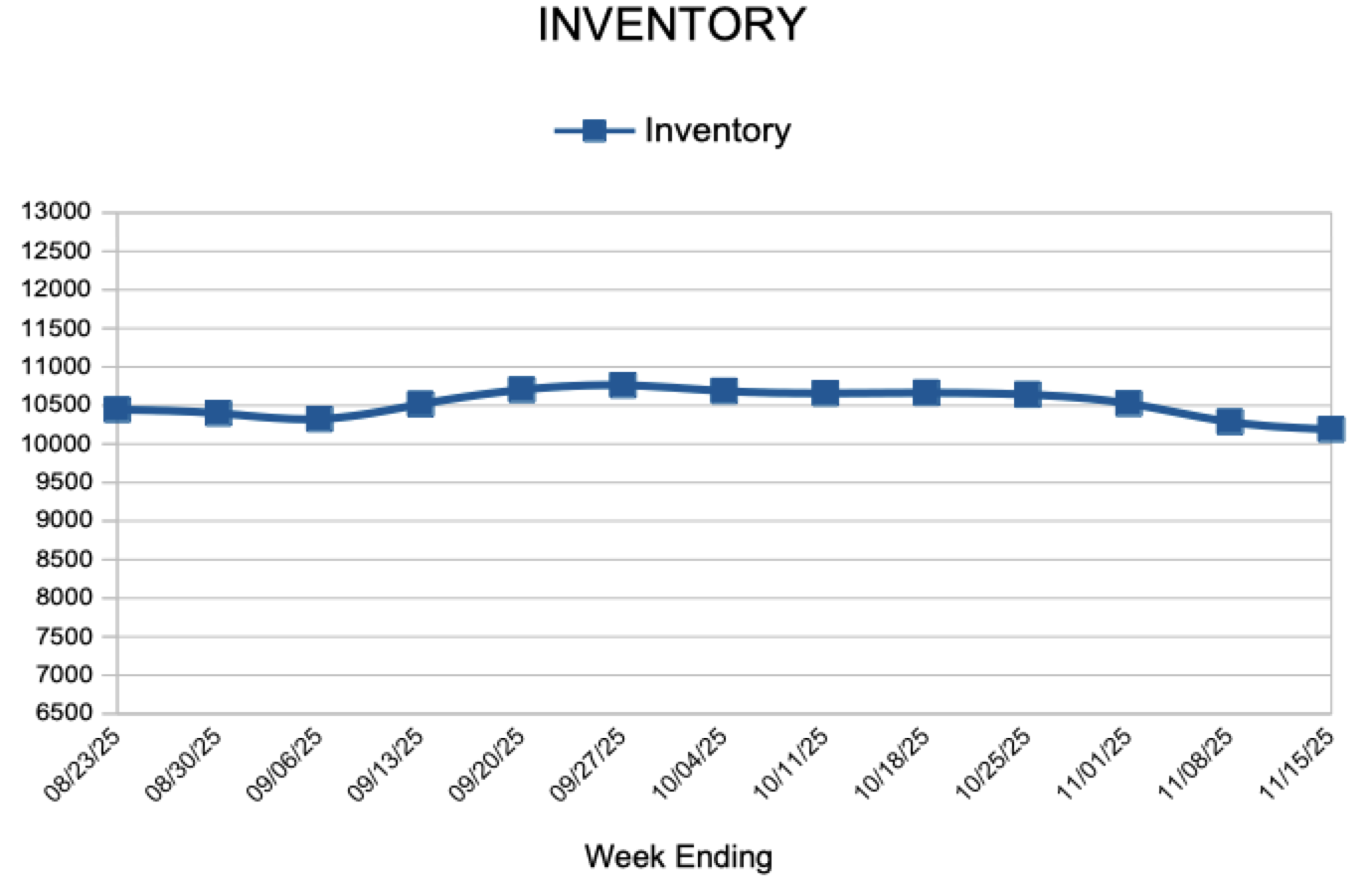

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 22:

- New Listings increased 8.1% to 949

- Pending Sales decreased 2.3% to 773

- Inventory increased 0.4% to 9,994

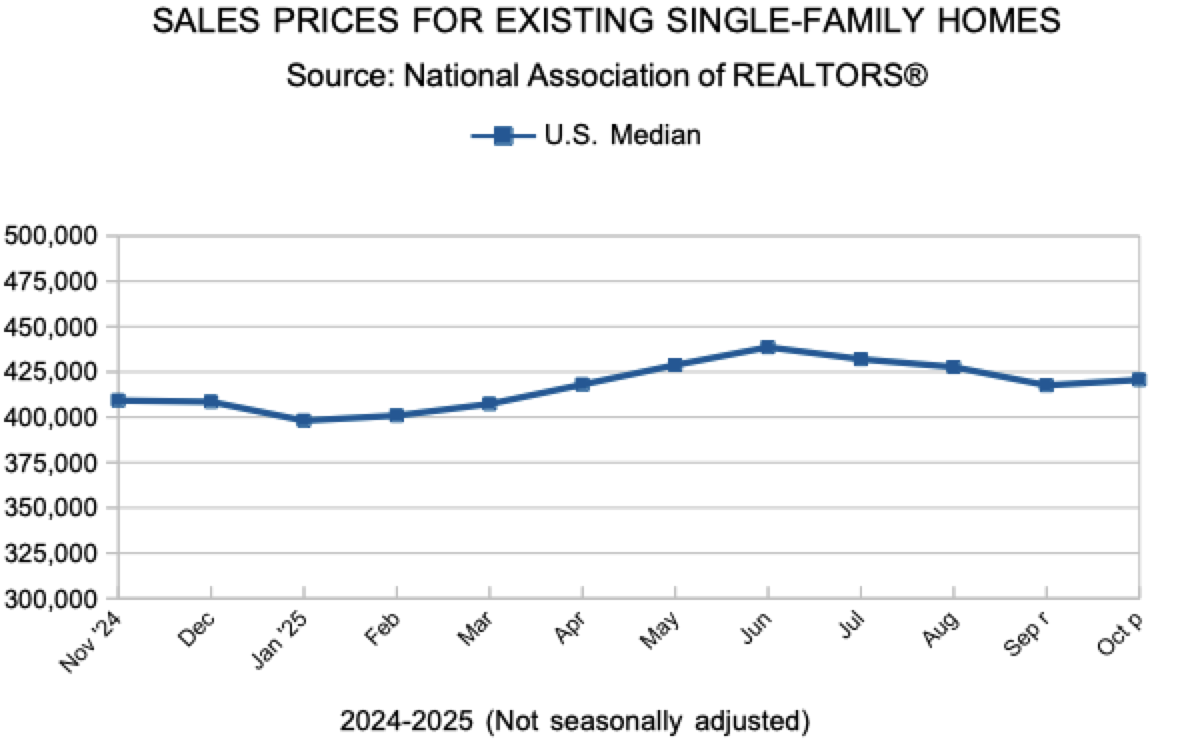

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.