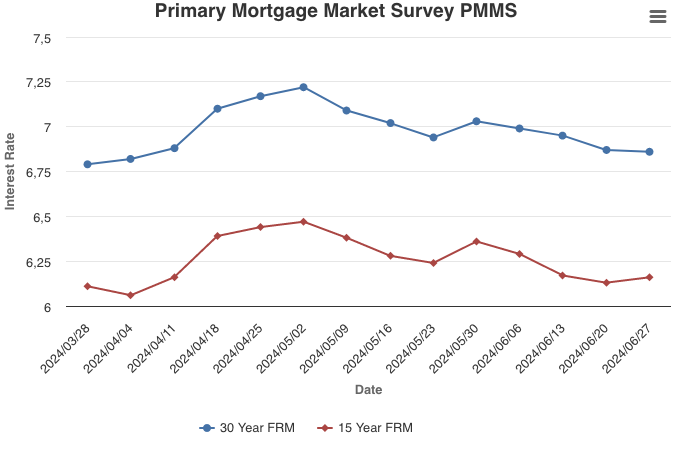

June 27, 2024

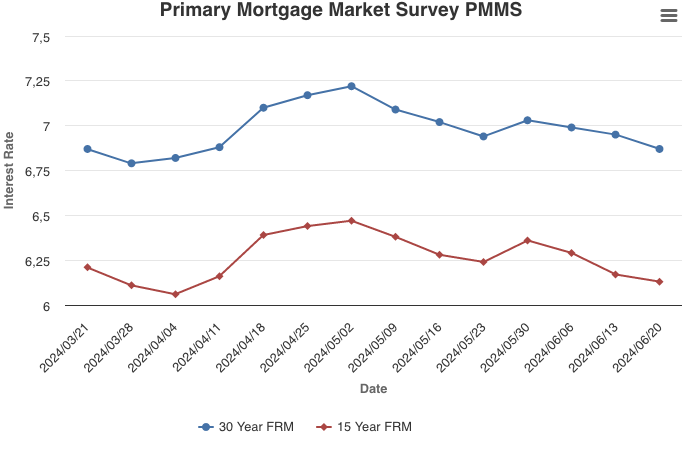

The 30-year fixed-rate mortgage continues to trend down, hitting the lowest level in almost three months. By historical standards, the economy is in good shape, and we expect rates to continue to come down over the summer months, bringing additional homebuyers back into the market.

Information provided by Freddie Mac.

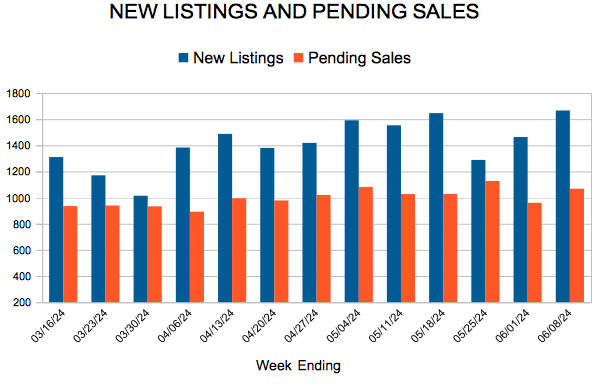

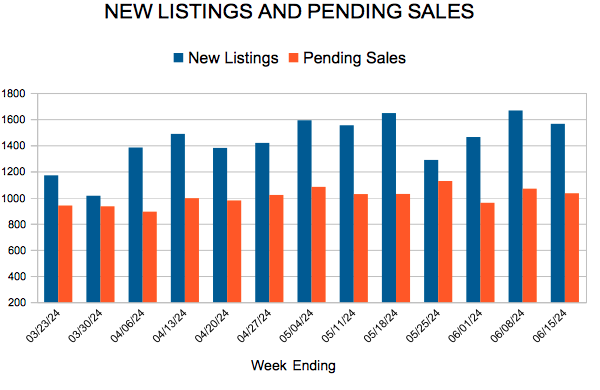

For Week Ending June 15, 2024

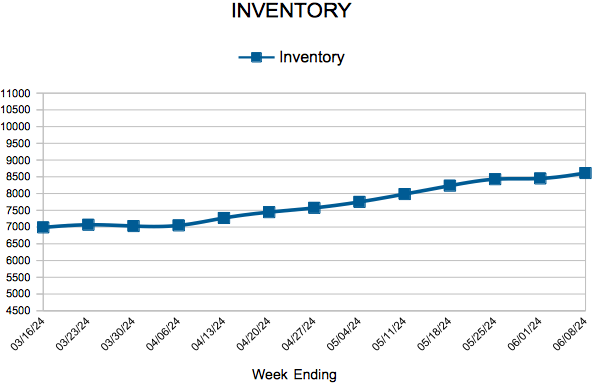

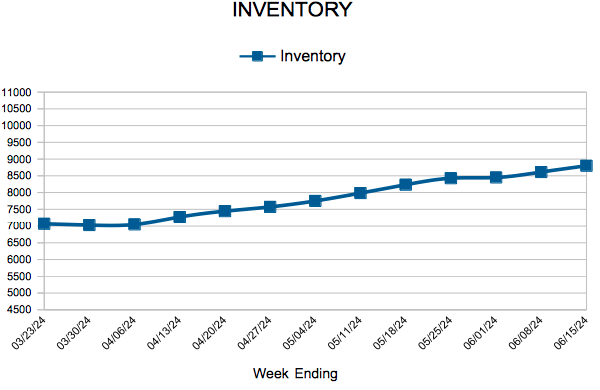

For Week Ending June 15, 2024